Exploring the Binance API in Python - Part II: Recent and Historical Trades

Table of Contents

Latest Price

Get the price at which the latest trade was executed:

r = s.get("https://api.binance.com/api/v3/ticker/price", params=dict(symbol="ETHAUD"))

The content of r.json():

{

"price": "3032.17000000",

"symbol": "ETHAUD"

}

Average Price

Get the average price of trades in the last 5 minutes:

r = s.get("https://api.binance.com/api/v3/avgPrice", params=dict(symbol="ETHAUD"))

The content of r.json():

{

"mins": 5,

"price": "3038.63364133"

}

Recent Trades

Get details of the most recent trades.

r = s.get("https://api.binance.com/api/v3/trades",

params=dict(symbol="ETHAUD", limit=500))

block = r.json()

This returns a list of dictionaries that contain details of the trade.

[

{

"id": 909049,

"isBestMatch": true,

"isBuyerMaker": false,

"price": "3041.05000000",

"qty": "0.68053000",

"quoteQty": "2069.52575650",

"time": 1619205370059

},

{

"id": 909050,

"isBestMatch": true,

"isBuyerMaker": true,

"price": "3034.11000000",

"qty": "0.67985000",

"quoteQty": "2062.73968350",

"time": 1619205476103

}

(...)

]

>>> data = create_trades_frame(block)

where

def create_trades_frame(trades):

frame = pd.DataFrame(trades) \

.assign(time=lambda trade: pd.to_datetime(trade.time, unit="ms"),

price=lambda trade: pd.to_numeric(trade.price),

qty=lambda trade: pd.to_numeric(trade.qty),

quoteQty=lambda trade: pd.to_numeric(trade.quoteQty))

return frame

| time | id | price | qty | quoteQty | isBuyerMaker | isBestMatch |

|---|---|---|---|---|---|---|

| 2021-04-23 17:39:09.812000 | 908551 | 2970.99 | 1.73541 | 5155.89 | False | True |

| 2021-04-23 17:39:13.854000 | 908552 | 2967.27 | 1.36668 | 4055.31 | False | True |

| 2021-04-23 17:39:15.059000 | 908553 | 2966.34 | 0.00941 | 27.9133 | True | True |

| 2021-04-23 17:39:16.948000 | 908554 | 2965.44 | 0.33998 | 1008.19 | False | True |

| 2021-04-23 17:39:16.949000 | 908555 | 2965.44 | 0.90989 | 2698.22 | False | True |

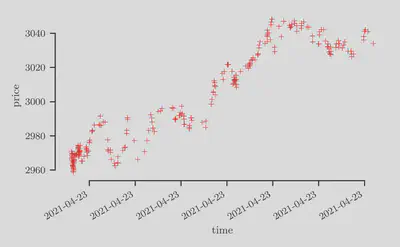

Scatter plot

sns.scatterplot(x="time", y="price", marker="+", data=data)

Historical Trades

num_blocks = 100

limit = 500

blocks = []

blocks.append(block)

for i in range(num_blocks):

from_id = block[0]["id"] - limit # get first trade of previous block

r = s.get("https://api.binance.com/api/v3/historicalTrades",

params=dict(symbol="ETHAUD", limit=limit, fromId=from_id))

block = r.json()

blocks.append(block)

Let us chain together these blocks of trades. In other words, we wish to convert this list of blocks, where each block contains a list of trades, into a single “flat” list of trades.

>>> data = create_trades_frame(chain(*blocks))

where we import the chain function from itertools:

from itertools import chain

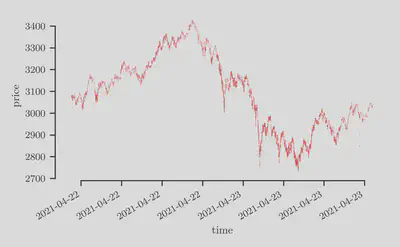

Scatter plot

sns.scatterplot(x="time", y="price", marker="x", s=0.5, alpha=0.2, data=data)

Open-High-Low-Close (OHLC) Data

data_ohlc = data.set_index("time").price.resample("30T").ohlc()

| time | open | high | low | close |

|---|---|---|---|---|

| 2021-04-21 22:30:00 | 3079.11 | 3085.95 | 3055 | 3074.12 |

| 2021-04-21 23:00:00 | 3071.99 | 3089.71 | 3039.44 | 3049.73 |

| 2021-04-21 23:30:00 | 3052.51 | 3096.03 | 3052.51 | 3065.93 |

| 2021-04-22 00:00:00 | 3066.54 | 3084.58 | 3012.32 | 3080.94 |

| 2021-04-22 00:30:00 | 3084.04 | 3133.27 | 3064.27 | 3132.16 |

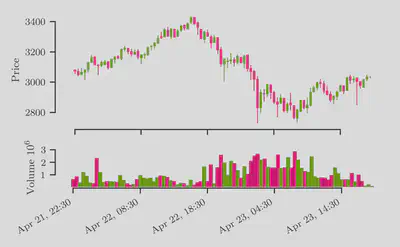

Candlestick chart

mpf.plot(data_ohlc, type="candle", style="binance")

Volume Data

series_volume = data.set_index("time").quoteQty.resample("30T").sum()

Concatentate this together with the OHLC DataFrame:

frame = data_ohlc.assign(volume=series_volume)

| time | open | high | low | close | volume |

|---|---|---|---|---|---|

| 2021-04-21 22:30:00 | 3079.11 | 3085.95 | 3055 | 3074.12 | 643973 |

| 2021-04-21 23:00:00 | 3071.99 | 3089.71 | 3039.44 | 3049.73 | 848766 |

| 2021-04-21 23:30:00 | 3052.51 | 3096.03 | 3052.51 | 3065.93 | 363078 |

| 2021-04-22 00:00:00 | 3066.54 | 3084.58 | 3012.32 | 3080.94 | 1.18854e+06 |

| 2021-04-22 00:30:00 | 3084.04 | 3133.27 | 3064.27 | 3132.16 | 901508 |

Candlestick chart with volume

fig, (ax1, ax2) = plt.subplots(nrows=2, gridspec_kw=dict(height_ratios=[3, 1]))

mpf.plot(frame, type="candle", style="binance", volume=ax2, ax=ax1)

fig.autofmt_xdate()

plt.show()

Candlestick

We can also obtain summarize the data into a format suitable candlestick chart at server-side by directly calling the following endpoint:

r = s.get("https://api.binance.com/api/v3/klines",

params=dict(symbol="ETHAUD", interval="4h"))

frame = pd.DataFrame(data=r.json(),

columns=["open_time",

"open",

"high",

"low",

"close",

"volume",

"close_time",

"quote_asset_volume",

"number_of_trades",

"taker_buy_base_asset_volume",

"taker_buy_quote_asset_volume",

"ignore"], dtype="float64") \

.assign(open_time=lambda interval: pd.to_datetime(interval.open_time, unit="ms"),

close_time=lambda interval: pd.to_datetime(interval.close_time, unit="ms")) \

.set_index("close_time")

If you don’t require fine-grained data on every single trade, then this might be more appropriate.

Links and Further Readings

- Blog posts:

- The first post in this series: Exploring the Binance API in Python - Part I: The Order Book

To receive updates on more posts like this, follow me on Twitter and GitHub!

Appendix

I - Import statements

import requests

import numpy as np

import pandas as pd

import matplotlib.pyplot as plt

import mplfinance as mpf

import seaborn as sns