Exploring the Binance API in Python - Part I: The Order Book

In this post, we will explore the live order book data on Binance through its official API using Python.

We directly interact with the API endpoints and explicitly make the low-level HTTP requests ourselves. If you’re just looking for a high-level way to interact with the API endpoints that abstracts away these details please check out python-binance, an unofficial, but slick and well-designed Python Client for the Binance API.

We will be making the requests using the requests library. Thereafter, we will process the results with pandas, and visualize them with matplotlib and seaborn. Let’s import these dependencies now:

import requests

import pandas as pd

import matplotlib.pyplot as plt

import seaborn as sns

To make a GET request for the symbol ETHBUSD from the /depth endpoint:

r = requests.get("https://api.binance.com/api/v3/depth",

params=dict(symbol="ETHBUSD"))

results = r.json()

Load the buy and sell orders, or bids and asks, into respective DataFrames:

frames = {side: pd.DataFrame(data=results[side], columns=["price", "quantity"],

dtype=float)

for side in ["bids", "asks"]}

Concatenate the DataFrames containing bids and asks into one big frame:

frames_list = [frames[side].assign(side=side) for side in frames]

data = pd.concat(frames_list, axis="index",

ignore_index=True, sort=True)

Get a statistical summary of the price levels in the bids and asks:

price_summary = data.groupby("side").price.describe()

price_summary.to_markdown()

| side | count | mean | std | min | 25% | 50% | 75% | max |

|---|---|---|---|---|---|---|---|---|

| asks | 100 | 1057.86 | 0.696146 | 1056.64 | 1057.2 | 1057.91 | 1058.49 | 1059.04 |

| bids | 100 | 1055.06 | 0.832385 | 1053.7 | 1054.4 | 1054.85 | 1055.82 | 1056.58 |

Note that the Binance API only provides the lowest 100 asks

and the highest 100 bids (see the count column).

Top of the book

The prices of the most recent trades will be somewhere between the maximum bid price and the minimum asking price. This is known as the top of the book. The difference between these two price levels is known as the bid-ask spread.

>>> frames["bids"].price.max()

1056.58

>>> frames["asks"].price.min()

1056.64

We can also get this information from the /ticker/bookTicker endpoint:

r = requests.get("https://api.binance.com/api/v3/ticker/bookTicker", params=dict(symbol="ETHBUSD"))

book_top = r.json()

Read this into a Pandas Series and render as a Markdown table:

name = book_top.pop("symbol") # get symbol and also delete at the same time

s = pd.Series(book_top, name=name, dtype=float)

s.to_markdown()

| ETHBUSD | |

|---|---|

| bidPrice | 1056.58 |

| bidQty | 7.555 |

| askPrice | 1056.64 |

| askQty | 7.43152 |

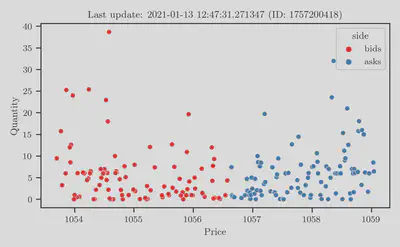

Scatter plot

Let us visualize all the order book entries using a scatter plot, showing

price along the

fig, ax = plt.subplots()

ax.set_title(f"Last update: {t} (ID: {last_update_id})")

sns.scatterplot(x="price", y="quantity", hue="side", data=data, ax=ax)

ax.set_xlabel("Price")

ax.set_ylabel("Quantity")

plt.show()

This is the most verbose visualization, displaying all the raw information, but perhaps also providing the least amount of actionable insights.

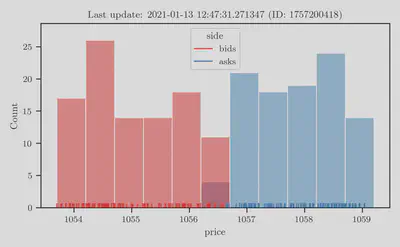

Histogram plot

We can compress this information into a histogram plot.

fig, ax = plt.subplots()

ax.set_title(f"Last update: {t} (ID: {last_update_id})")

sns.histplot(x="price", hue="side", binwidth=binwidth, data=data, ax=ax)

sns.rugplot(x="price", hue="side", data=data, ax=ax)

plt.show()

This shows the number of bids or asks at specific price points, but obscures the volume (or quantity).

This is obviously misleading.

For example, there could be 1 bid at price

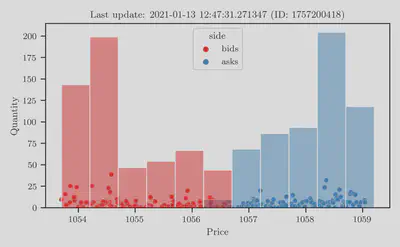

Weighted histogram plot

This is easy to fix, simply by weighting each entry by the quantity.

This just amounts to setting weights="quantity":

fig, ax = plt.subplots()

ax.set_title(f"Last update: {t} (ID: {last_update_id})")

sns.histplot(x="price", weights="quantity", hue="side", binwidth=binwidth, data=data, ax=ax)

sns.scatterplot(x="price", y="quantity", hue="side", data=data, ax=ax)

ax.set_xlabel("Price")

ax.set_ylabel("Quantity")

plt.show()

This paints a more accurate picture about supply-and-demand, but still offers limited actionable insights.

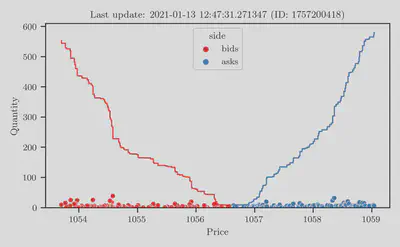

Weighted empirical CDF (ECDF) plot – aka the “Depth Chart”

Now we finally arrive at the depth chart, which is a popular visualization that is ubiquitous across exchanges and trading platforms. The depth chart is essentially just a combination of two empirical cumulative distribution function (CDF), or ECDF, plots.

More precisely, they are weighted and unnormalized ECDF plots.

As before, they are weighted by the quantity and are unnormalized

in the sense that they are not proportions between

In code, this amounts to making calls to sns.ecdfplot with the options

weights="quantity" (self-explanatory) and stat="count" (to keep the plot

unnormalized). Finally, for the bids, we add the option complementary=True.

Putting it all together:

fig, ax = plt.subplots()

ax.set_title(f"Last update: {t} (ID: {last_update_id})")

sns.ecdfplot(x="price", weights="quantity", stat="count", complementary=True, data=frames["bids"], ax=ax)

sns.ecdfplot(x="price", weights="quantity", stat="count", data=frames["asks"], ax=ax)

sns.scatterplot(x="price", y="quantity", hue="side", data=data, ax=ax)

ax.set_xlabel("Price")

ax.set_ylabel("Quantity")

plt.show()

To receive updates on more posts like this, follow me on Twitter and GitHub!